Sometimes these assets will still be in service after their useful lives as classified by the irs have ended.

Macrs life of carpet.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

Simple mortgage calculator like appliance depreciation carpets are normally depreciated over 5 years.

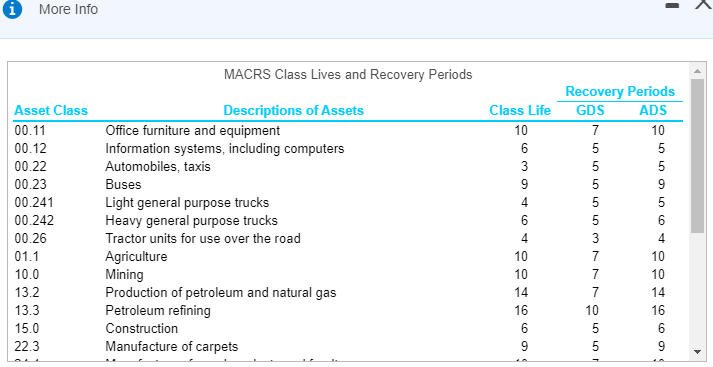

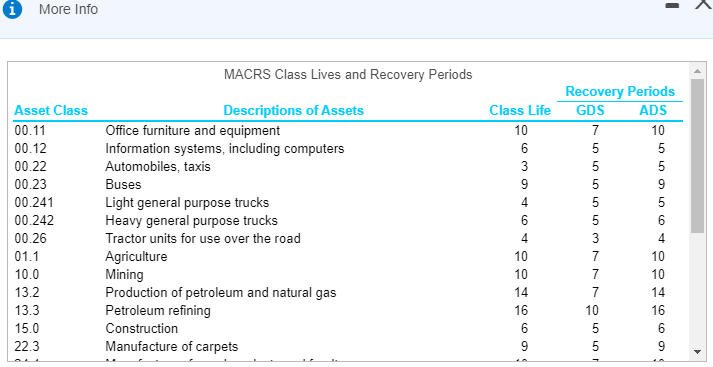

The macrs asset life table is derived from revenue procedure 87 56 1987 2 cb 674.

But if the carpet in a residential rental property is glued down it is considered to be part of the building structure and must be depreciated over a whopping 27 5 years.

Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years.

Appliances carpet and furniture when used in connection with rental property all have a five year useful life.

The property class generally determines the depreciation method recovery period and convention.

Most flooring is considered to be permanently affixed.

Since these floors are considered to be a part of your rental.

Most repair costs that are results of the tenant destructive actions are fully tax deductible in the year incurred.

Thus if the class life of carpet e g is more than 4 but less than 10 years the landlord depreciates carpet over 5 years because it is 5 year property.

In this case the assets continue to serve you but you cannot claim any depreciation on them.

Each item of property that can be depreciated under macrs is assigned to a property class determined by its class life.

But what is class life.

These types of flooring include hardwood tile vinyl and glued down carpet.

If the carpet is tacked down it is classified as personal property and is depreciated over five years.